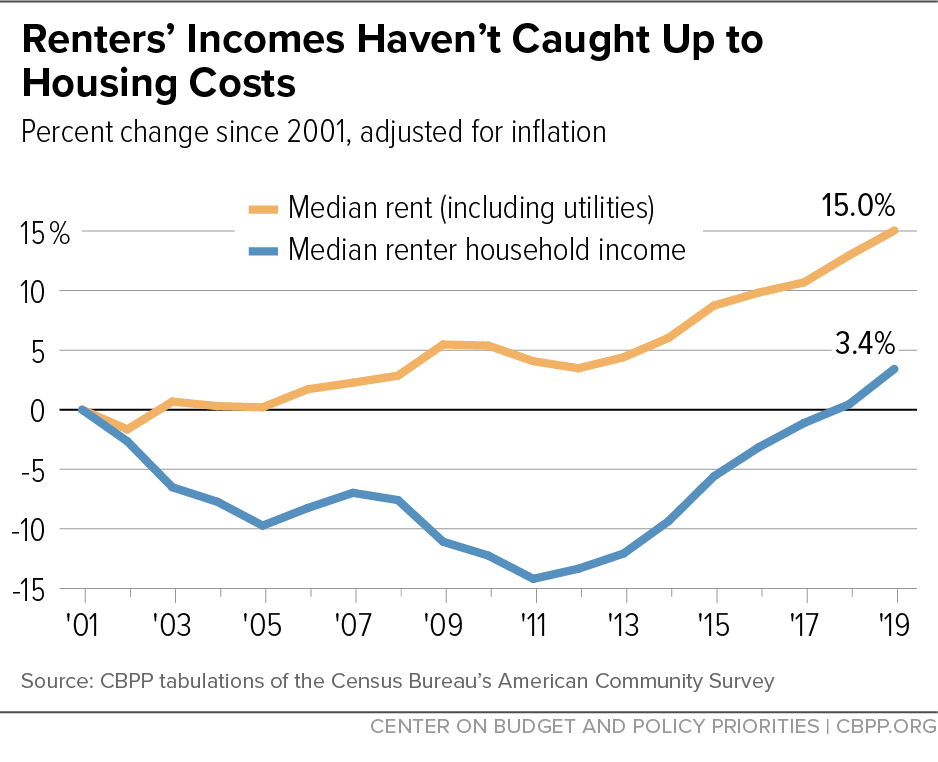

Over the past four decades, a significant and concerning trend has emerged within the housing market – the unprecedented inflation of housing prices compared to average income levels. This growing divide has raised numerous concerns and challenges for individuals and families seeking affordable housing. Similarly, as the prices for home purchases increase, so does the price to rent. In this article, we will delve into the causes and consequences of this disparity, shedding light on the implications it has for society as a whole.

(This graph shows how extreme the disparity between the average income of American renters has been compared to the average price to rent)

- The Soaring Housing Market:

The housing market has experienced remarkable growth over the past 40 years, with housing prices skyrocketing in many regions. Factors such as population growth, urbanization, limited housing supply, and increased demand have contributed to this surge. However, this expansion has outpaced the growth of average income levels, creating an affordability crisis that affects individuals and families across various socioeconomic backgrounds. - Stagnant Wage Growth:

While housing prices have soared, average income levels have failed to keep pace. Wages have remained relatively stagnant for many workers, leading to an ever-widening gap between what people earn and the cost of housing. This disparity has made it increasingly challenging for individuals, particularly those in low- to middle-income brackets, to afford suitable housing without significant financial strain. - Impact on Housing Affordability:

The disproportionate inflation of housing prices in relation to average income has had a profound impact on housing affordability. Many individuals and families are forced to allocate a substantial portion of their income towards housing costs, leaving less room for other essential expenses like healthcare, education, and savings. This financial burden often perpetuates a cycle of economic instability, making it difficult for individuals to build wealth and invest in their future. - Generational Challenges:

The effects of this divide are felt keenly across generations. Younger generations, such as millennials and Gen Z, face significant hurdles in entering the housing market due to soaring prices and limited affordable options. The dream of homeownership becomes increasingly elusive, potentially impacting their long-term financial security and wealth accumulation. Additionally, the intergenerational wealth gap widens as housing becomes increasingly unaffordable for younger generations, exacerbating socioeconomic inequalities. - Social and Economic Implications:

The disproportionate inflation of housing prices compared to average income has broader social and economic implications. It contributes to increased socioeconomic inequality, as access to affordable housing becomes a privilege reserved for a fortunate few. This disparity can lead to social unrest, displacement, and the erosion of community cohesion. Moreover, the housing market’s exorbitant growth can have a destabilizing effect on the overall economy, with potential consequences for financial markets and lending practices.

Final Verdict

The extreme and despair inflation between housing prices and average income over the past 40 years has created a significant challenge for individuals, families, and society as a whole. The widening gap between what people earn and the cost of housing has resulted in reduced affordability, limited access to homeownership, and increased socioeconomic inequality. Addressing this issue requires a multi-faceted approach involving policy interventions, increased housing supply, and efforts to boost income growth. Only through collaborative action can we strive for a more equitable and sustainable housing market that ensures housing affordability for all.